Did you know that moving averages have made their way into the world of sports? In sports like baseball and basketball, analysts use moving averages to evaluate player performance over a specific period. So, maybe the player selection or game strategies of your favorite team were shaped, in part, by the insights from MAs.

In the world of fixed time trading, MAs are also in great favor. So, if you’re building a powerful analytical toolset, incorporating moving averages should be high on your priority list.

What are moving averages, and how are they calculated?

Moving averages offer insights into the general direction of price movements and help identify significant market trends. By calculating the average price over a specific period, MAs effectively smooth out short-term fluctuations, providing a clearer picture of the underlying trend.

The calculation process involves summing up a series of prices within the chosen timeframe and dividing the sum by the number of periods. As new prices become available, the oldest price is dropped, and the most recent price is included in the calculation, which effectively creates a moving effect. The resulting line acts as a reference point, highlighting the general direction of price movement.

Different types of moving averages

Here are a few examples of moving averages commonly used in FTT:

- Simple Moving Average (SMA) provides a straightforward interpretation of the overall.

- Exponential Moving Average (EMA) places more weight on recent price data, making it more responsive to recent price movements. This type reacts more quickly to price changes, which can be advantageous for short-term strategies.

- Weighted Moving Average (WMA) assigns different weights to each price point within the chosen period. Typically, more recent prices are given higher weights, and older prices have lower weights.

- Hull Moving Average (HMA) is a relatively new type of moving average that seeks to reduce lag and provide smoother signals.

The best EMA for fix time trading is arguably the 12- or 26-day EMA, which are popular among other types of short-term traders. The 12-day EMA is known for its responsiveness to recent price movements, and the 26-day EMA offers a slightly longer-term perspective while still retaining a level of responsiveness.

How to set up moving averages on trading platforms

While the exact steps may vary slightly depending on the platform you’re using, here is a general guideline that applies to many popular trading platforms:

- Open a chart for the chosen asset.

- Locate the indicator or studies library on your platform.

- Search for the Moving Average indicator and click to select.

- Customize the parameters in the settings window, like the time period and the type of moving average (e.g., SMA or EMA).

- Specify the desired time period and click Apply or OK to add the MA to your chart.

- Customize the appearance of the line, like a specific color or line thickness (optional).

- If you want to add more moving averages to your chart, repeat the above steps, selecting different time periods or types of moving averages.

How to identify trend direction with MAs

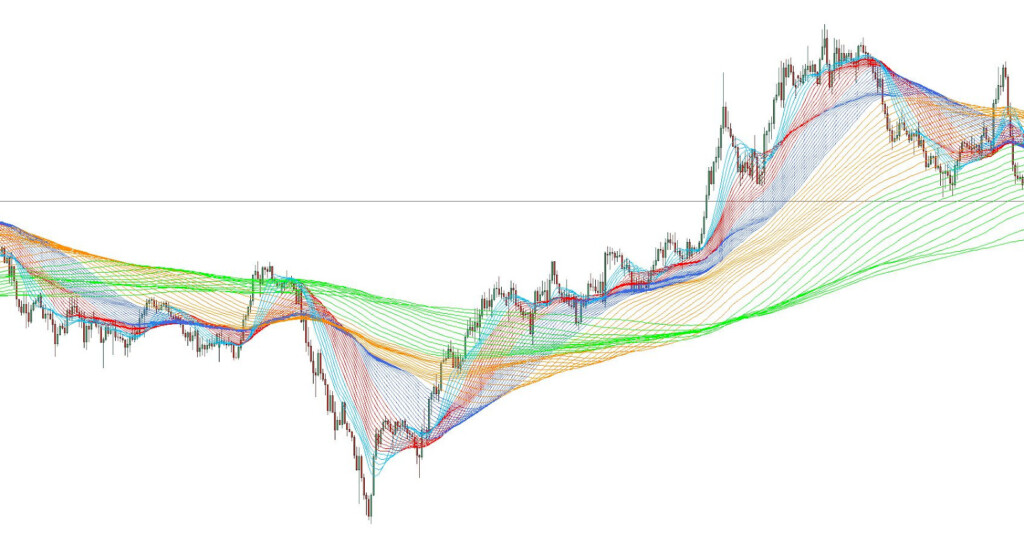

When the price consistently stays above a single moving average, it suggests an overall uptrend. But to further confirm the uptrend, you can plot multiple moving averages on the chart. By using more than two moving averages, you can gain a deeper understanding of the trend’s strength.

In an uptrend, the faster-moving average (with a shorter time period) should be positioned above the slower-moving average (with a longer time period). This alignment indicates that the trend is robust since the recent price action is consistently higher than the average price over a longer period. In a downtrend, the faster-moving average should be below the slower-moving average.

Trading strategies with moving averages

Each strategy offers a unique approach to market analysis and can be applied to different trading styles and timeframes:

MA crossover strategy

When the shorter period moving average crosses above the longer period moving average, it’s called a golden cross. Traders often interpret this crossover as a confirmation of upward momentum and look for opportunities to enter long positions or add to existing ones.

The opposite is when the shorter MA crosses below the longer one — a death cross.

MA bounce strategy

The moving average bounce trading system focuses on observing the fluctuations in an asset’s price to establish an average trend line. Traders employ this to capitalize on profitable opportunities by trading the “bounces” when the stock price rebounds against the prevailing average direction.

MA breakout strategy

Here are the buy signals used in the MA breakout strategy:

- The price should be above multiple moving averages, showing potential buying strength.

- The main line of the Stochastic oscillator should be above the signal line, indicating positive momentum.

- The Stochastic should be below the overbought level of 80.

- The price should break out above a significant resistance level, signaling a potential upward price continuation.

For a sell signal, the MA setup should be the opposite, ADX should be above the 20 level, and the negative direction indicator (-DI) should be above the positive direction indicator (+DI).

Fine-tuning moving average strategies for FTT

The choice of moving average periods depends on the trading time frame and the asset being traded. As mentioned, the best moving average for FTT, which is a short-term approach, is any MA that’s fast enough to catch these movements.

That said, some assets may exhibit more pronounced short-term movements, and others may require slightly longer moving average periods to filter out market noise and provide reliable signals. Ultimately, FTT traders should experiment with different MA periods and assess their effectiveness through backtesting and real-time trading.

Sources:

What is a moving average and how can it benefit you? Bankrate

The perfect moving averages for day trading, Investopedia